Create categories for your financial goals and see your progress at a glance. Goal Tracking: Turn your financial goals into reality.We’ll calculate the interest and time saved for every extra dollar you put towards debt. Loan Calculator: Find more money for your debt with our loan planner tool.Real-Time Expense Tracking: View changes to your budget in real time across devices, making it simple to share finances with a partner.Bank Sync: Securely link your accounts and see your complete financial picture in one place.Gain total control of your money with YNAB.

See a complete view of your personal finances. Pay off more debt, grow your savings, and reach your goals faster.

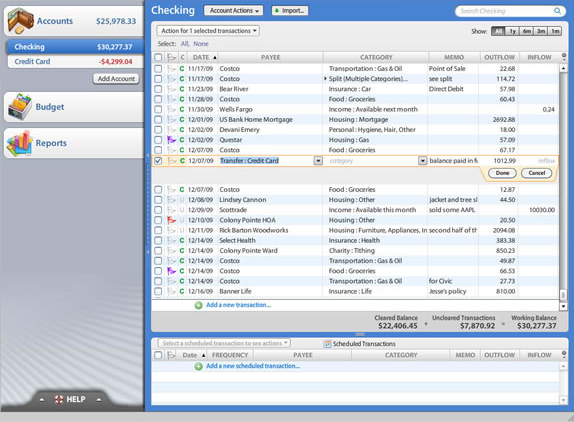

On average, new budgeters save $600 in their first two months and more than $6,000 their first year. Get a handle on your personal finances by budgeting with YNAB-a proven method and budgeting app that gives you real results. YNAB employs an effective 4 rule budgeting approach with an elegant interface to create one of the most helpful budgeting applications out there.YNAB-Budgeting, Personal Finance, Expense Tracker Some users report that this problem worsens over time as your accounts grow although the developers are working hard to solve it. The main drawback of YNAB is that it doesn't integrate with online banking and the Adobe AIR interface, while looking great, can sometimes be slow and unresponsive. You can also carry-over overspending (or underspending of course) from month to month. YNAB allows you to spread spending across different categories so if you need more money for essentials one month rather than entertainment you can do so and it will even things out for you. Each section gives you advise and tips on how to organize your accounts effectively. YNAB uses what it calls the 4 rules of cash flow - Stop Living Paycheck to Paycheck, Give Every Dollar A Job, Save For A Rainy Day and Roll With The Punches. However, You Need A Budget is named as such because its all about budgeting - something it does very well indeed and if you're having financial problems, you're advised to listen to what it says. You can of course, just ignore all this and open an account. When you enter the main screen, YNAB acts as a kind of financial adviser, suggesting ways in which you should be managing your money. When opened for the first time, YNAB asks if you'd like to associate your downloaded bank statements with it or allow another application - such as Moneydance - to take care of that.

0 kommentar(er)

0 kommentar(er)